Singapore has long been recognized as a global hub for real estate investment, offering stability, high liquidity, and a robust legal framework. Among the most sought-after segments is the luxury condominium market, which combines prime locations, world-class amenities, and long-term capital appreciation potential. Newport Residences exemplifies the characteristics that make luxury condos a compelling choice for investors, blending lifestyle appeal with strong investment fundamentals.

Why Singapore’s Luxury Condo Market Attracts Investors

Singapore’s property market is consistently viewed as a safe haven for both domestic and international investors. Key factors include political stability, strong economic fundamentals, and transparent regulations. For luxury properties, additional considerations such as design quality, location, and lifestyle amenities play a significant role in determining both rental yield and long-term capital growth.

Newport Residences offers a combination of these factors, making it attractive not only for homeowners but also for discerning investors looking for sustainable returns in a premium market segment.

Prime Location as an Investment Driver

Location remains one of the most critical factors in real estate investment. Luxury condominiums situated near financial districts, transport hubs, schools, and lifestyle amenities are highly desirable and tend to appreciate faster over time.

Newport Residences is strategically positioned to leverage Singapore’s urban infrastructure, providing residents and investors with excellent connectivity and access to essential amenities. Properties in such prime locations maintain high demand from tenants and buyers alike, ensuring long-term investment security.

Capital Appreciation Potential in Luxury Condos

Investors in luxury condominiums often prioritize capital appreciation over immediate rental income. Prime developments with limited supply and exceptional design typically outperform standard properties, especially in high-demand urban districts.

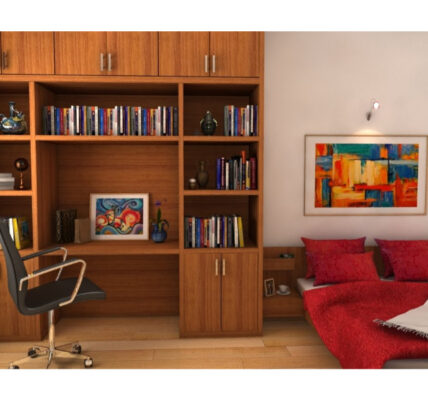

Newport Residences offers strong potential for appreciation due to its distinctive architectural design, premium finishes, and integration of lifestyle and wellness amenities. These features position it as a sought-after address, appealing to high-net-worth individuals and expatriates.

Rental Yield Considerations

While luxury condos may have higher entry prices, they often provide attractive rental yields due to their premium appeal. Expatriates, corporate tenants, and affluent locals frequently prefer ready-to-move-in residences with top-tier amenities.

Newport Residences aligns with these rental trends, offering high-quality units with lifestyle-driven features that attract long-term tenants. Its modern facilities, wellness-focused amenities, and prime location enhance rental demand, translating to consistent income streams for investors.

Diversification and Risk Management

Investing in luxury condos can also serve as a diversification strategy within a real estate portfolio. Unlike mass-market properties, high-end developments tend to appeal to niche markets less affected by short-term market fluctuations.

Including a property like Newport Residences in an investment portfolio provides exposure to Singapore’s premium real estate segment, balancing risks while potentially enhancing overall returns. Its unique combination of design, location, and lifestyle amenities mitigates the risks associated with conventional property investments.

Timing and Market Insights

Successful real estate investment requires understanding market cycles, government policies, and macroeconomic trends. Singapore’s luxury condo market responds to both local and global factors, including interest rates, urban development plans, and expatriate demand.

Newport Residences benefits from careful market timing and strategic positioning, appealing to buyers and investors who recognize the long-term advantages of premium, well-located developments. Staying informed about market trends enables investors to maximize returns while minimizing risks.

Lifestyle-Driven Demand as a Value Multiplier

In the luxury property segment, lifestyle offerings—such as wellness facilities, recreational spaces, and green areas—directly influence property valuation. Buyers and tenants increasingly prioritize developments that enhance quality of life and support holistic living.

Newport Residences exemplifies this trend with thoughtfully designed amenities that appeal to health-conscious, sophisticated residents. Its focus on lifestyle, wellness, and sustainability not only attracts high-quality tenants but also strengthens long-term capital appreciation.

Sustainability and Long-Term Investment Security

Sustainable design has become a critical differentiator in the luxury market. Properties incorporating eco-friendly materials, energy-efficient systems, and green spaces tend to retain their value better and appeal to environmentally conscious buyers.

By integrating sustainable architecture, smart home technology, and energy-efficient amenities, Newport Residences provides long-term investment security. This approach ensures the property remains relevant and desirable in a market that increasingly values environmental responsibility.

Conclusion: Smart Strategies for Investing in Luxury Condos

Investing in Singapore’s luxury condo market requires a careful balance of location, design, market insight, and lifestyle appeal. High-end developments offer strong capital appreciation potential, attractive rental yields, and long-term portfolio diversification, making them an essential consideration for serious investors.

Newport Residences exemplifies these investment principles. Its prime location, architectural sophistication, wellness-focused amenities, and sustainable design create a property that appeals to both homeowners and investors. For those seeking a secure, high-value, and lifestyle-driven investment in Singapore’s competitive real estate market, Newport Residences represents a compelling opportunity that combines modern luxury with financial prudence.